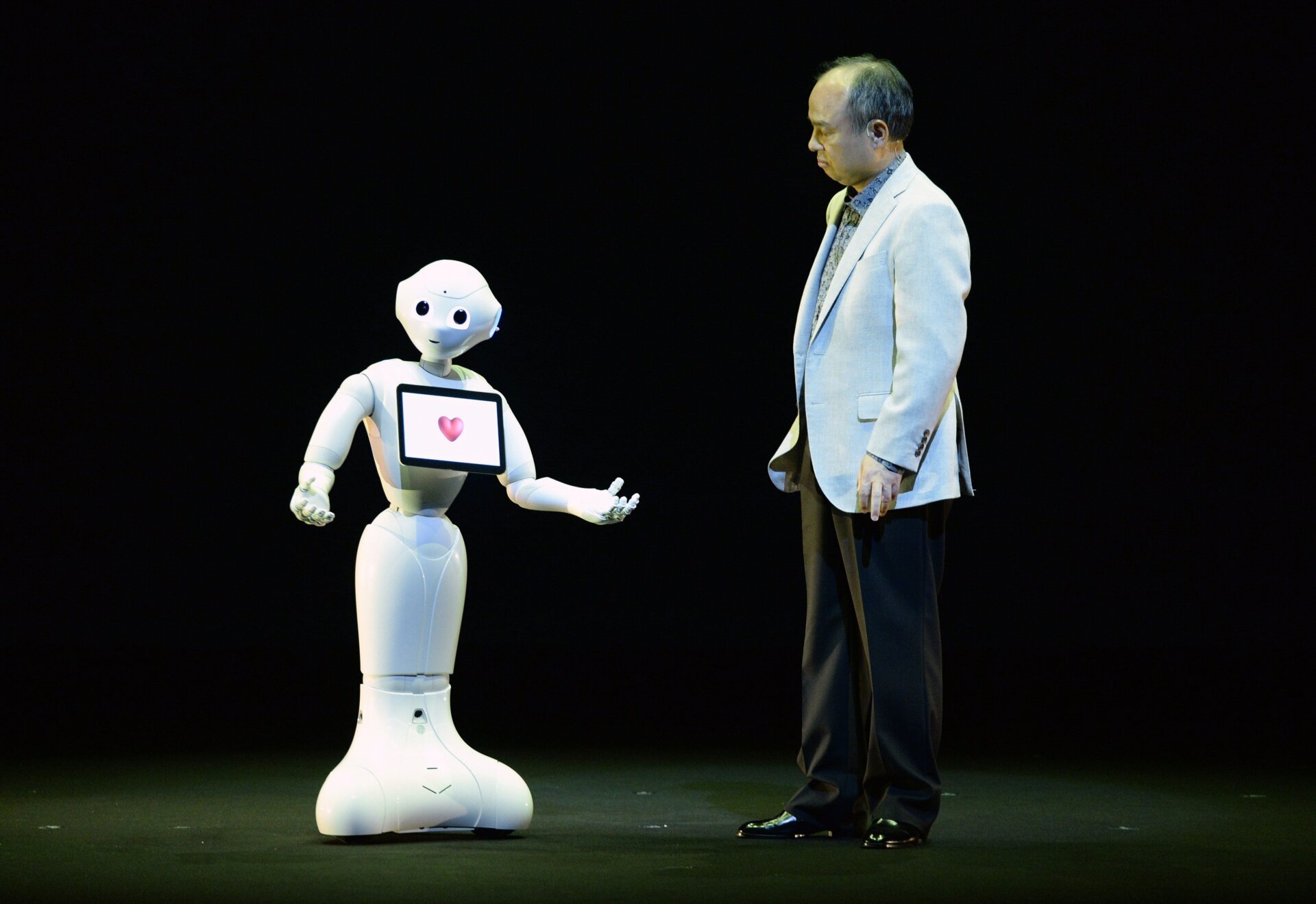

AI Bets Mint Money for Masayoshi Son

Japanese billionaire Masayoshi Son’s fortune added $11 billion in just the first two weeks of August as his SoftBank Group’s aggressive push into artificial intelligence buoyed shares to historic highs. Son’s net worth now stands at $33.3 billion, solidifying his position as the second-richest person in Japan, according to the Bloomberg Billionaires Index.

The resurgence comes amid a broader recovery at SoftBank’s flagship Vision Fund, coupled with sizable payouts from asset sales, including stakes in T-Mobile US, that have bolstered Son’s financial firepower.

These gains are fueling further bets on AI hardware and technology companies, with Son’s investments across chipmakers like Nvidia and Taiwan Semiconductor Manufacturing Co. gaining ground in the recent quarter.

How Did Masayoshi Son Get to Be So Wealthy?

At 68, Son’s wealth has long been characterized by volatility.

During the dot-com bubble of 2000, he briefly surpassed Bill Gates in fortune, only to see that wealth evaporate as tech stocks collapsed. His early investments in Alibaba and exclusive rights to Apple’s iPhone sales in Japan helped him stage a dramatic comeback, reaching a peak of $38.3 billion in 2021 following record profits from SoftBank’s investments in newly listed tech firms.

But no one has been immune to routs in tech: the value of Son’s fortune has waned in recent years amid the tech downturn and shifting global markets.

AI’s Huge Pays Off

Son’s latest surge reflects his unwavering confidence in AI’s potential.

After years of caution highlighted by a sharp retrenchment in 2022 amid falling tech valuations, he has renewed his focus on AI hardware, increasing holdings in Nvidia and TSMC in the March quarter despite critics warning of a bubble and oversupply risks.

These investments are now contributing significantly to SoftBank’s earnings, with the company’s stock serving as an on-the-ground proxy for what many see as a burgeoning AI infrastructure boom.

Recent developments suggest Son’s strategic moves aren’t limited to chipmakers.

SoftBank is also backing a major push into electric vehicles through its acquisition of Foxconn’s Ohio plant. That effort is being seen as integral to the company’s Stargate AI data center project, a $500 billion initiative aiming to partner with firms like OpenAI and Oracle.

SoftBank’s expanding digital footprint includes plans to list its payments unit, PayPay, in the U.S., hinting at potential future payouts that could further enhance Son’s wealth.

But questions around his personal stakes in these investments and the governance issues they raise have heightened scrutiny among investors, who question whether his interests are best for the company’s long-term survival.

As Son continues to bet heavily on AI’s transformative power, his recent wealth sprint underscores his belief that the tide is turning, and that his vision for a future dominated by intelligent infrastructure is finally gaining momentum.